Understanding office cleaning jobs: Pathways and prospects

Did you know that office cleaning jobs are among the most sought-after positions in facilities management? Discover the dynamics, opportunities, and growth potential of this essential field. Office cleaning jobs are crucial in maintaining the health and productivity of workplaces….

Everything you need to know about renting a car

Did you know that renting a car can save you time, money, and create a more memorable travel experience? Explore the ins and outs of car rentals and enhance your next adventure! When planning a trip, one of the most…

TikTok Followers Growth Strategy: Boost Your Exposure and Attract More Followers

As TikTok continues to dominate as one of the most popular social platforms worldwide, many users are looking for ways to grow their influence and increase their follower count. Whether you’re a TikTok beginner just getting started or an experienced…

Cosmetic Packaging in the United States: Safety, Materials, and Industry Trends

Cosmetic packaging in the U.S. is more than just attractive design—it ensures product safety, preserves ingredient stability, and enhances the user experience. Proper packaging protects creams, serums, and makeup from contamination while complying with strict FDA regulations, including labeling, ingredient…

Understanding legal services: A comprehensive guide

Did you know that nearly 70% of legal problems go unaddressed due to misconceptions about legal services? In this insightful guide, we unravel various legal services available and how they can empower you in everyday situations. Navigating the legal system…

Choosing the best unlimited cell phone plans for your needs

Are you overwhelmed by the choices of unlimited cell phone plans available today? Join us as we break down the best options, their features, and tips for choosing the right one for your lifestyle. With the growing reliance on smartphones,…

Discover the Best Car Rental Options Near You

When it comes to renting a car near your location, there are numerous options available that cater to various preferences and budgets. Discover the best car rental services nearby to make your travel experience hassle-free and enjoyable. Looking for convenient…

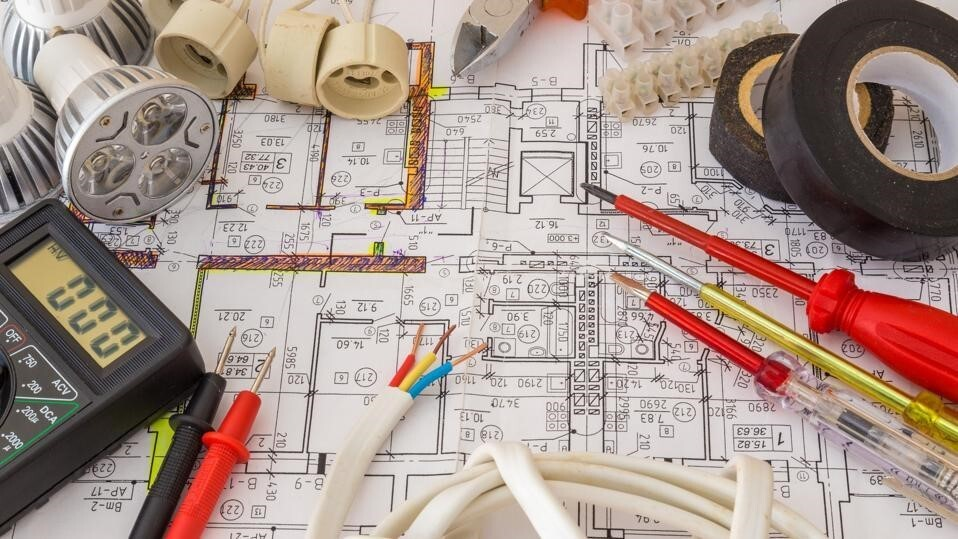

Introduction to Electrical Engineering Courses

Electrical engineering courses provide students with a foundation in how electrical systems, circuits, and modern technologies work. These courses combine scientific principles, practical problem-solving, and real-world applications, making electrical engineering one of the most versatile and impactful technical fields today….

Office Cleaning Services Guide

A clean office is essential for maintaining productivity, employee health, and a professional image. This guide covers the common office cleaning services, how to choose the right service provider, and the importance of keeping your workspace tidy. 1. Common Office…

How to Find a Job Online: A Simple and Practical Guide

In today’s digital age, finding a job online has become the preferred method for many job seekers. The internet allows you to quickly access job listings, apply with ease, and discover opportunities worldwide. Below are some effective strategies for finding…